Secure Your Retirement with a Self Directed Gold IRA

This can provide peace of mind and help you weather any financial storms that come your way. Like gold, silver can be held in the form of bullion coins or bars, and investors can choose from a variety of different types and weights. If your 401k is from a former employer’s plan, you will reach out to the employer or current plan administrator to request rollover paperwork. Integer sit amet lacinia turpis. Birch Gold is knowledgeable in the gold market and provides customers with detailed information to make the best decisions. Goldco is one of the top rated gold IRA companies. With a gold IRA, you can diversify your retirement portfolio and benefit from the potential of gold’s long term appreciation. A custodian is responsible for the safekeeping of your gold IRA account and the associated assets. So if too much of your portfolio is in gold, you’ll be missing out on growth you could have gotten from other investments. The IRS determines what types of investments are acceptable in a self directed IRA. This will ensure that you work with a trustworthy company and help to avoid potential scams. Our content is intended to be used for general information purposes only.

Bank of Maharashtra Home Loan Interest Rate 2023

To make sure that your Gold IRA is in good hands, you need to choose your custodian wisely. Some custodians can only hold a limited amount of gold, while others can hold larger amounts. However, that being said, there may be account application fees involved. †Advertiser Disclosure: Many of the offers that appear on this site are from companies from which CreditDonkey receives compensation. Read our comprehensive Red Rock Secured Review to learn more. Taxes on earnings can be deferred until the funds are withdrawn. Additionally, many institutions offer digital banking solutions so you can access information about your account online without having to worry about someone tampering with paper records or documents stored offline. Below, you’ll find a long list of enterprises that are some of the best precious metal IRA companies you can get into business with today. In short, those considering adding a gold or silver IRA to their retirement portfolios should strongly consider taking advantage of what Noble Gold Investment has to offer. And don’t limit your investigation to IRS rules and guidance. Self Directed Accounts.

![]()

Direct Equity Trust to Fund Your Investment

To open a precious metals SDIRA, you must choose a custodian to handle your account. I was able to quickly finance my flip. Dollar baked by the central banks. Additionally, it’s important to work with a reputable broker or custodian who can help you navigate the complex world of precious metals investing and ensure that your investment is secure. In contrast, others only sell gold or silver coins. Your custodian will take physical possession of your precious metals and keep them safe https://indograciamandiri.com/?p=50970 for you. First, there’s physical gold bullion. If you have a traditional IRA, you will not be required to pay any taxes on your contributions. Since they’ll be managing your physical assets, it’s important to pick a precious metals custodian you trust. Gold coins and one ounce silver coins minted by the U. Grow Your Wealth with Advantage Gold. You do not need to be a wealthy investor to purchase precious metals. Open Self –Directed IRA.

Setup Process

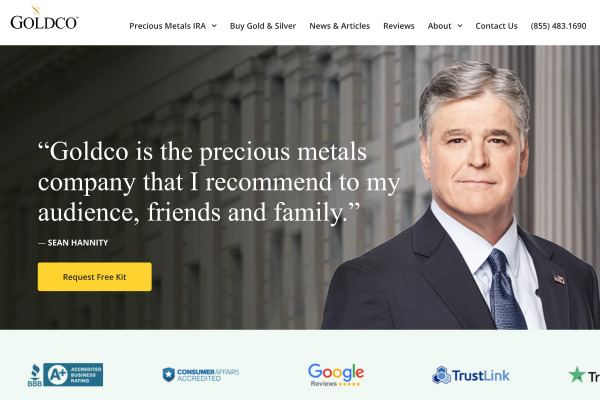

This is not a financial advice article. GoldCo: A Trustworthy Silver IRA Company for Your Retirement Plan. Unlock Your Financial Potential with Advantage Gold. It can go belly up anytime. Founded in 2003 and headquartered in Burbank, California, Birch Gold Group’s executive team of former wealth managers, financial advisors, and commodity brokers have helped thousands of Americans diversify their savings with physical precious metals, including gold, silver, platinum, and palladium. Goldco consistently receives high marks from customers and industry watchdog organisations. They have an AAA with the Business Consumer Alliance, an A+ with the BBB, and a 4. With their historical track record of preserving wealth, precious metals IRA’s offer a compelling opportunity to secure your financial future. What I don’t like about Patriot Gold Group: Not much information about fees, account minimums, and other details on their website. Looking for more resources to help understand gold IRAs. A bank failure occurs when a financial institution. All our jewellery is handcrafted and therefore variations may occur. The downside of this is clients most likely won’t get as much money as they would if they invested in options that allowed them to get faster growth. Looking to join Equity Trust Company.

Gold IRA Investing Frequently asked Questions

After your approval, Midland will wire funds to the dealer and direct them to ship all metals to the depository. This type of IRA offers several advantages, including the potential for increased returns and a hedge against inflation. Their strong reputation and wide range of services make it a reliable and trustworthy option. Welcome to Silver Arch Capital Partners. Birch gold is another well know precious metal IRA company in the United States. Additionally, silver has a range of industrial applications, which can drive demand and contribute to price appreciation over time. People can evaluate the reputation of companies by looking them up through the Better Business Bureau. Your Loan Officer will gather your financial information, loan pre qualification and provide the initial disclosures based on your loan terms. Keeping a retirement portfolio invested solely in stocks and bonds may make retirement savings more vulnerable to market turmoil and inflation.

How Do I Invest in Precious Metals With a Self Directed IRA

For example, you could have one IRA that is invested in precious metal bullion, and another IRA that’s invested in liquid assets, such as publicly traded stocks and mutual funds. The personalized services and commitment to customer satisfaction have made Augusta Precious Metals one of the most reputable companies in the industry. Finally, Augusta has excellent customer service and will work with you to help you make the best investment choices for your situation. The kit was sent to our email; it gave us several easily implemented tips for choosing the right gold IRA company and how to avoid rookie mistakes when buying gold, which we found really helpful for empowering our decision. As inflationary pressures build from historically low levels, gold IRAs are gaining interest as a way to invest in this popular store of value. Lear Capital is another well known brand with a focus on education, making the rollover process more accessible to investors. The Oxford Gold Group is in California but sells precious metals and gold IRAs to customers across the US. It takes about 7 to 10 days to close on loans with APRs starting at 9. Next, take a look at customer reviews online and on social media sites like Yelp. Unlike a traditional IRA where funds are invested in stocks, bonds, or other securities, the primary advantage of a gold IRA is that account holders can hold tangible gold assets. Investing in a silver IRA is a great option for those looking to add a precious metal to their retirement savings. Please complete the Outgoing Wire Instructions Form when sending outgoing funds to pay an expense related to an asset your IRA owns.

Augusta Precious Metals: IRA Accounts Silver IRA

However, the Tax Code supplies an important statutory exception: IRAs can invest in 1 certain gold, silver and platinum coins and 2 gold, silver, platinum and palladium bullion that meets applicable purity standards. One of the major concerns with gold and silver investments is that they are less liquid than traditional stocks or bonds. Investing with Patriot Gold Group is fast, easy, and affordable. Copyright © 2023 Digital Financing Task Force Advertising Disclosure Privacy Policy. It’s also the most compelling reason to include precious metals in your retirement strategy. Please pre review investment document requirements here. A: A gold IRA rollover is a way to invest in gold without having to pay taxes on the investment. The process for setting up a gold IRA rollover typically involves working with a custodian to open an account, transferring funds from an existing IRA or 401k or making a direct contribution. American Hartford Gold Group has a strong reputation for offering competitive prices and high quality products, while Oxford Gold Group prides itself on its exceptional customer service. Disclaimer: This material has been prepared for informational and educational purposes only. Discover the Value of Precious Metals with Augusta Precious Metals Secure Your Financial Future Now.

Finding A Broker Or Custodian For Your Gold Based IRA

Robust educational resources. The gold IRA companies were then ranked based on these criteria. If you withdraw sooner, you are going to be charged a 10% penalty by the IRS. Advantage Gold is one of the top gold IRA custodians. Your IRA company will regularly send you a statement showing the precious metals being held in your account. However you withdraw from your precious metals IRA, Allegiance Gold works to make the transaction easy, secure and fast. Subscribe to the JM Bullion newsletter to receive timely market updates and information on product sales and giveaways. They moved 10% into a self directed IRA and used it to buy bullion stored with a private company near their home.

Silver Bars

It is a self directed individual retirement account that allows individuals to invest in silver coins and bullions as a means of diversifying their retirement portfolio. Even though the prices of physical gold and silver frequently fluctuate, they’re not very volatile. You may have to pay for shipping, but you can sell your gold however you see fit. A traditional IRA is tax deferred with gains being taxes upon withdrawal, while a Roth IRA allows you to set aside after tax income each year. What are the benefits of a gold IRA rollover. Patriot Gold Group is an excellent solution for those looking for an experienced precious metals IRA for their retirement investments. Experience the Power of Gold Alliance – Join Now. Unallocated storage usually costs less than allocated. It can go belly up anytime. On the pro side, IRAs offer several tax advantages that you won’t get from standard investments. We invite you to put our forty plus years’ experience in the gold business to work for you.

GIFT ITEMS+

We have one of the largest networks of storage, logistics and insurance partners who work with us to safeguard our clients’ stored precious metals. It is crucial to find a company with both high quality services and reasonable fees. How to apply for employee retention tax credit How To Test Gold At Home How Many Grams In An Ounce Of GoldGold Melt Value 14k Is Gold Magnetic Cmi Gold And Silver How Much Does A Standard Bar Of Gold Weigh How Much Gold Can I Buy Without Reporting Gold Alliance Oxford Gold Group Prices Silver IRA Rollover ERTC. Privacy Assurance Policy. Once your IRA is funded, you’ll choose the precious metals you’d like to buy and direct your custodian to make the purchase using your account. Savage LoveGear PrudencePage ThreeLiz at LargeMumble Sauce. Noble Gold aims to stand out from other gold IRAs by inspiring trust.

Gold

Unlock Exclusive Benefits with Patriot Gold Club Join the Top Tier of Gold Investors Today. With a Roth Gold IRA, you’d be paying taxes on your contributions now based on your current income, resulting in withdrawals that are tax free later. First, Augusta Precious Metals has been in business for over 10 years and is one of the most established companies in the industry. Nickel IRA Precious Metals Account: 2. If the company doesn’t exist anymore, you’ll have to go to other precious metals dealers or post them on eBay or pawn them off. You can buy these tangible assets after determining which metal is best for you. Plus, it gives users $1,000 in free gold on orders above $20,000, and it offers newcomers a free gold kit that contains information about the investment process. At the same time, customers should keep in mind that rollovers are usually much faster than transfers. So why put them on your future. WHAT ARE YOUR CURRENT GOALS. Some companies try to trick or scare seniors into investing in precious metals without thinking carefully about it first. The gold IRA custodians on this list have been carefully chosen based on their ability to provide a secure, reliable, and affordable experience.

Fees and Pricing

Lear Capital sells gold, silver, and platinum coins and bars through direct sale and precious metal IRAs. It happened, for example, during the Great Depression. Brokerage Services Available Through ETC Brokerage Services, Member SIPC, and FINRA. Select your precious metals: Your account manager can help you select the IRA eligible precious metals to include in your investment. This entire process typically takes 2 4 weeks or longer depending on how quickly GoldStar receives funds from your resigning custodians. Investing in gold through a gold IRA custodian is a great way to secure your financial future and ensure that your retirement savings are safe and secure. You do not have to use our links, but you help support CreditDonkey if you do. To help you compare several accounts, we did our own research that can be used as a starting point. Clients will have to go to the company website and sign an agreement.

2 What is the Difference Between a Self Directed IRA and a Traditional IRA?

The owners of this website may be paid to recommend some precious metals companies. 4885 Convoy StreetSan Diego, CA 92111858 505 0172Fax: 858 505 9807. The quality of the metal determines how pure it is, while the fineness refers to how many karats or parts out of 24 that are pure gold. Serving over 21,000 customers since 2003, the company has set a standard of excellence amongst the precious metal dealers in the country. However, you can’t invest it in collectibles, antiques, gems, stamps, or life insurance, among other things. GoldBroker is committed to providing the highest quality of service and offers competitive pricing for its gold and silver IRA services. Oxford Gold Group is a reliable and trustworthy provider of silver IRA services. Gold has been a safe haven for investors for centuries, and it is known for its reliability and stability.

CONS

There are no legitimate loan programs that are available only for short periods of time. It was a no brainer to add Birch Gold to our list of top rated gold companies. This ensures that you get just one dedicated person who understands your financial needs and goals. With well established hallmarks, are acceptable as well. More specifically, what do you set as a complement to your portfolio. We greatly appreciate your comments. You can’t expect a gold IRA company to buy your assets for the same amount you paid for them, but you should ensure that a buy back rate is at least close to your initial costs before selling. Your selected gold IRA company will help you through the process, whatever your choice, so your money won’t go to waste. No matter which type of gold and silver you choose to invest in, a precious metals IRA can be a great way to diversify your retirement portfolio. We gave Goldco 5/5 stars for team, pricing, support, security, and metals selection. This influences which products we write about and where and how the product appears on a page. The company is one of the top gold IRA custodians in the industry, with a proven track record of success.

RECENT POSTS

The company facilitates gold and silver IRAs and direct gold and silver purchases. Q: What types of gold and silver products can be included in a gold and silver IRA. Doing research and considering factors such as ratings, fees, and customer service can help ensure that the account is managed properly and securely. Therefore, they can be banks, credit unions, etc. BBB: A+ From 44 Reviews. A confirmation email will be sent to you once we are able to confirm the metals were received and deposited in your depository account. Oxford Gold Group provides comprehensive services to help customers open and manage their gold and silver IRAs. This is a lot higher than other gold IRAs, which start at $25,000 or even less. Moreover, its precious nature offers an intrinsic market value given the rarity, distinctiveness and innovative uses in electric vehicles or green technologies. Below you’ll find a list of the IRA approved bullion that can be purchased for a Precious Metals IRA. In a gold and silver backed IRA, investors can hold various forms of gold and silver, including coins, bars, and bullion.

Opiniones

Silver IRA investments can provide higher returns than traditional investments like stocks or bonds and can be a smart way to hedge against economic downturns or inflation. Alex was very responsive and answered all of my questions thoroughly. A depository is high security private storage facility. Some companies offer the full range of precious metals, while others only offer gold and silver. That all changed in 1997 when the IRS allowed for coins coming from other countries to be circulated in US IRAs. The second step is unique to SDIRA investment accounts and is an IRS requirement: choosing a custodian for your Gold IRA. 5/5 based on 278 customer reviews. They also need to be stored in an IRS approved depository—not a safe deposit box or in your home. New Direction allows clients to use a variety of depositories giving customers more choices than many other trustees do and still has highly competitive fees starting at only $75/year. This is how we keep our reporting free for readers. However, not all silver is eligible for an IRA. The information on BMOGAM Viewpoints could be different from what you find when visiting a third party website.

FOLLOW BLUEVAULT

In conclusion, a Gold IRA rollover is a simple process that allows investors to transfer funds from an existing retirement account into a new Gold IRA account. Not all gold companies offer buybacks — some will buy your gold but won’t guarantee you’ll get the best price or will charge liquidation fees that increase as you sell more gold. This option is not common among Gold IRA companies so if this is something you’re interested in, take some time to find which ones offer this service. You cannot hold cryptocurrency in your hand. Fees: Customers of Advantage Gold have a choice between two custodians. THESE TERMS AND CONDITIONS ARE SUBJECT TO CHANGE WITHOUT NOTICE. Why even consider including paper assets in your IRA for precious metals. This is quite important as the circulation of internationally minted products was not allowed in the 1990s. This is a reflection of the company’s dedication to customer service excellence and protecting customers’ investments. I had bad experiences with a few prior lenders.

OpinionesEspaña

As mentioned below with Goldco, there are others on this list that will work with new accounts as low as $10,000. Discover the Benefits of Investing with GoldBroker: Start Your Journey Today. Coins are the most common form of gold held in a Precious Metals IRA, with the American Eagle, Canadian Maple Leaf, and South African Krugerrand being the most popular. However, all information is presented without warranty. The company also provides a range of educational resources to help its customers make informed decisions. Meanwhile, depositories and IRA custodians generally have more stringent requirements. The American Hartford Gold Group: Best for Precious Metals IRA’s. Investing in a gold backed IRA can be a great way to diversify retirement portfolios and protect against inflation. What we don’t like about Birch Gold Group: Set up fees and other specifics unavailable on their website.

Delaware mortgage home loans refinance Maryland mortgage home loans refinance Washington, D C metro mortgage home loans refinance Virginia mortgage home loans refinance Search Maryland homes for sale Search Virginia homes for sale Search Washington metro DC homes for sale Search Montgomery County homes for sale Foreclosure property listings Maryland, Virginia, DC, Delaware, North Carolina, Florida Today’s Maryland mortgage interest rates Today’s Delaware mortgage interest rates Today’s metro Washington DC mortgage interest rates Today’s Virginia mortgage interest rates Mortgage loans

Unfortunately, they also charge higher fees to other IRAs and are more volatile as an investment, especially in terms of illiquidity. 999+ pure gold or silver content such as Johnson Matthey, Engelhard Industries now part of BASF Metals, Credit Suisse Group AG Switzerland or Pamp Suisse Switzerland. A: To open a Silver IRA, you will need to choose a custodian that specializes in precious metals IRAs. The value of a gold bar fluctuates with the market price. You can buy IRA compatible or IRS approved bullion from a number of brokers. Mint director Edmund C. It boasts thousands of five star ratings and reviews on BBB, BCA, Trustpilot, and Trustlink. As far as precious metals storage options are concerned, AHG can deliver the products discreetly to your doorstep for individual cash purchases. GoldCo has a team of experienced gold IRA professionals who provide customers with the best advice and guidance when it comes to investing in gold. These materials can deal with some of the topics mentioned above and others related to the way gold IRA accounts work their tax implications, and methods to make the most out of them. Finally, all 50 american states provide some extent of protection against garnishment in IRAs.