Contents:

Different goods produced in the country are measured in different units, e.g., cloth in metres, milk in litres, sugar in kilograms. Without a common unit of measure, exchange of goods and services becomes very difficult. Values of all goods and services can be expressed in a single common unit called money. Again without a measure of value, there can be no pricing process. Without a pricing process, organised marketing and production is not possible. Thus, the use of money as a measure of value is the basis of specialised production.

Governments Can’t Blame Inflation On Energy Anymore – Hedgeye

Governments Can’t Blame Inflation On Energy Anymore.

Posted: Tue, 07 Mar 2023 08:00:00 GMT [source]

Measure the broad money by including other forms of savings. Money is accepted as a means of exchange or as a measurement of the value of goods. It is fascinating to imagine a world where the money wouldn’t exist.

RBI publishes figures for four alternative measures of money supply, viz. M1, M2, M3 and M4.

This measure reflects almost all the cash in circulation, with both the public and financial institutions. Currency with public + Demand deposits with the Banking system + other deposits with RBI. A suitable monetary system is one that satisfies both domestic and international trade requirements. OD represents the other types of deposits made in RBI, like deposits from public sector financing, foreign banks, or international institutions such as the IMF.

One outright way of increasing the stock of money is by monetising government deficits. The government borrows money from the RBI against G-secs and the RBI prints new notes to finance this loan. The government pays its expenditures with this new cash, and money stock increases.

M2 is also known as narrow money which includes all of the M1. In addition, it also includes all the savings deposits of the post office banks. The process can be understood easily if we consider a simple stylised example. It pays for thr gold or foreign exchange by issuing currency to the seller.

What is money and money supply?

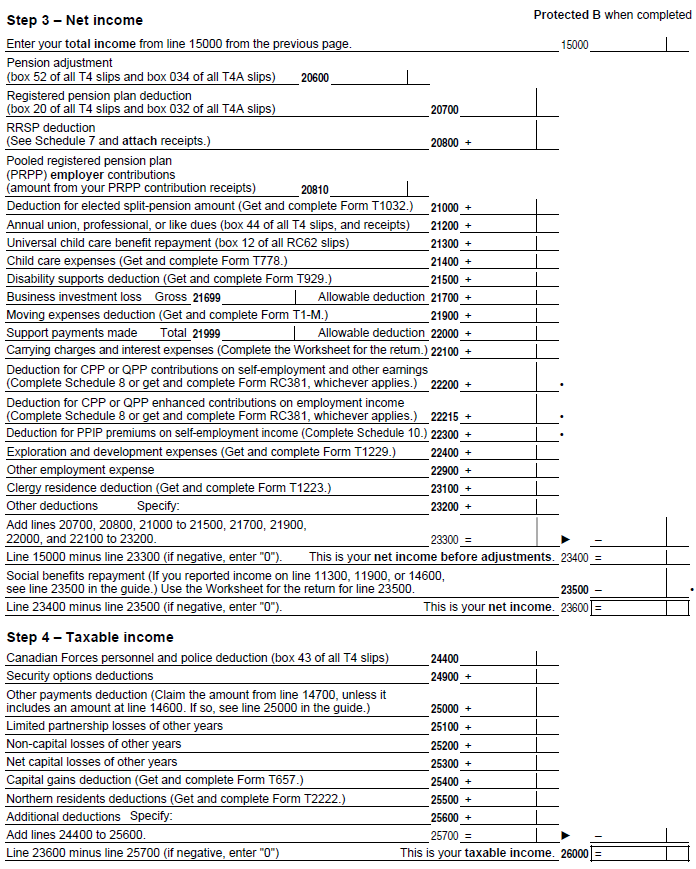

Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. There are four ways of measuring the money supply – M1, M2, M3 and M4. It is money alone that can help a person live their life the way they want.

- Cash reserve ratio is an essential monetary policy tool used for controlling the money supply in the economy.

- The producer of jute may want shoes in exchange for his jute.

- M3 is the most commonly used measure of the money supply.

- Please verify with scheme information document before making any investment.

- Another Function ‘Liquidity of Money’ is added these days.

The logic behind allowing banks to offer loans in excess of their cash holdings is that they do not expect all the dues against the bank to be encashed in a single instant. So, banks are able to economise on the use of cash and create multiple deposits on the basis of their cash holding. This raises the cash assets of banks which can again use a percentage of the additional cash receipts to create more demand deposits and thereby increase the supply of money in the system. For example, if the cash reserve ratio that banks must maintain is 10%, then a Rs 100 injection of cash into the banking system can create upto Rs 1,000 of demand deposits.

Currency design in India

When thousands of articles are produced and exchanged, there will be unlimited number of exchange ratios. Absence of a common denominator in order to express exchange ratios create many difficulties. Money obviates these difficulties and acts as a convenient unit of value and account.

All the aspects of M3 and the savings of the post office banks count to form M4. It is because the savings deposits with the post office saving banks are not as easy to convert into cash. It consists of demand deposits of the public held by the commercial banks. Demand deposits are those deposits that one can encash by furnishing cheques. Measure of the money supply and net time deposits with the banks. Time deposits are those deposits that have a specified period of term for maturity and interest rates.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment. These gradations are in decreasing order of liquidity. Lenders too are unwilling to take risks as slowing discretionary spending slows demand for manufactured and industrial goods. Doubtlessly money helps in removing the difficulties of barter system as explained above.

ClearIAS Study Materials for UPSC Prelims and Mains

As mentioned before, which type of money is called broad money production is largely governed by the Reserve Bank of India or RBI. Therefore, it is the RBI that is responsible for the measures of the money supply. The second form of currency in India, the coins, are produced in two variants viz token coins and the standard coins characterized as full-bodied coins.

This article will give you complete notes on the topic of money supply in economics class 12. You only get your investment and returns when the bonds reach maturity. Other examples of broad money are stocks, Mutual Funds, and commodities. Even if buyer and seller of each other commodity happen to meet, the problem arises in what proportion the two goods are to be exchanged. Each article must have as many different values as there are other articles for which it is to be exchanged.

Currency with the public is arrived at after deducting cash with banks from total currency in circulation. M3 is the most commonly used measure of money supply. Thus conventionally money performs the following four functions each of which overcomes one or the other difficulty of barter. Here you can find the meaning of What is narrow money and broad money? Besides giving the explanation of What is narrow money and broad money? Has been provided alongside types of What is narrow money and broad money?

- Above all, it lets policymakers get a better understanding of future inflationary trends—how much goods and services’ prices are likely to increase.

- Broad money may include various deposit-based accounts that would take more than 24 hours to reach maturity and be considered accessible.

- Therefore, demand for money is the demand for liquidity.

- It is this peculiarity which distinguishes money from all other commodities.

Among https://1investing.in/ity aggregates, data on L1 and L2 are published on monthly basis, while for L3 data is published once in a quarter. L1 +Term deposits with Term Lending Institutions and Refinancing Institutions + Term Borrowing by FIs + Certificates of Deposit issued by FIs. Where C represents the currency, including both paper currency and coins.

As the price levels lower due to increased money supply, the production in business will increase to accommodate people’s increased spending. Thus, the money supply and money demand directly impact the macroeconomics of a nation’s market. M3 is known as broad money as more items are included in this measure when compared to M1 which is known as narrow money. However, the savings and current account deposits decreased by 8%.

Money as store of value solves the barter problem of lack of storing wealth . Money as measure of value or a unit of account solves the barter problem of lack of common measure of value. Money measures exchange value of commodities and makes keeping of business accounts possible. Double coincidence of wants means what one person wants to sell and buy must coincide with what some other person wants to buy and sell. ‘Simultaneous fulfillment of mutual wants by buyers and seller’s is known as double coincidence of wants.

It means that if the reserve ratio is higher, then the money multiplier will be lower and the banks need to keep more reserves. As a result, they will not be able to lend more money to individuals and businesses. The money supply in the economy can be influenced by the Central Bank of the country.

In English & in Hindi are available as part of our courses for Humanities/Arts. Download more important topics, notes, lectures and mock test series for Humanities/Arts Exam by signing up for free. Central bank money – obligations of a central bank, including currency and central bank depository accounts. Therefore, the supply of money is calculated in different ways. The word fiduciary is derived from the Latin word Fiducia.

For example, the money you have invested in Bonds will take several months to get accessible for transactions. M1 and M0 are the official terms used to define narrow money in the United States and the UK respectively. We get this term from the fact that M1 is considered to be the narrowest money in the Economy. In other words, narrow money refers to the physical money that is easily available for monetary transactions.